Passive ETFs and tracker funds have become common way to achieve a low-cost diversified portfolio across global indices. The proportion to which the biggest greenhouse gas emitters feature in these indices, and correspondingly in my own passive investments bothered me, so I wanted to see what options I had to tackle it.

If you’re just interested in the climate friendly ETFs I found, feel free to skip ahead there!

Typically there are two options to potentially influence companies when you hold shares in them:

- Use voting rights to influence, embarrass or outright force companies to change for the better.

- ‘Divest’ and move your money elsewhere.

Most commonly the fund managers hold shares on our behalf (assuming they are physically replicated) – and can use their aggregate holding to wield significant influence, both through direct relationships and exercising voting rights at shareholder meetings.

As individual investors via funds, we typically have no say on how they choose to vote, so it’s worthwhile understanding how the fund managers use the voting rights for the investments we make.

How do the biggest investment managers vote on climate issues?

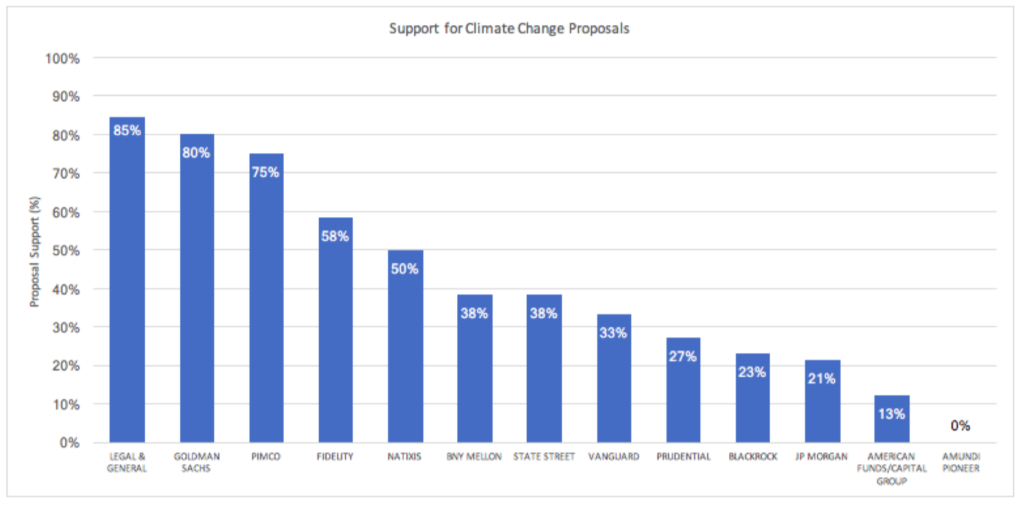

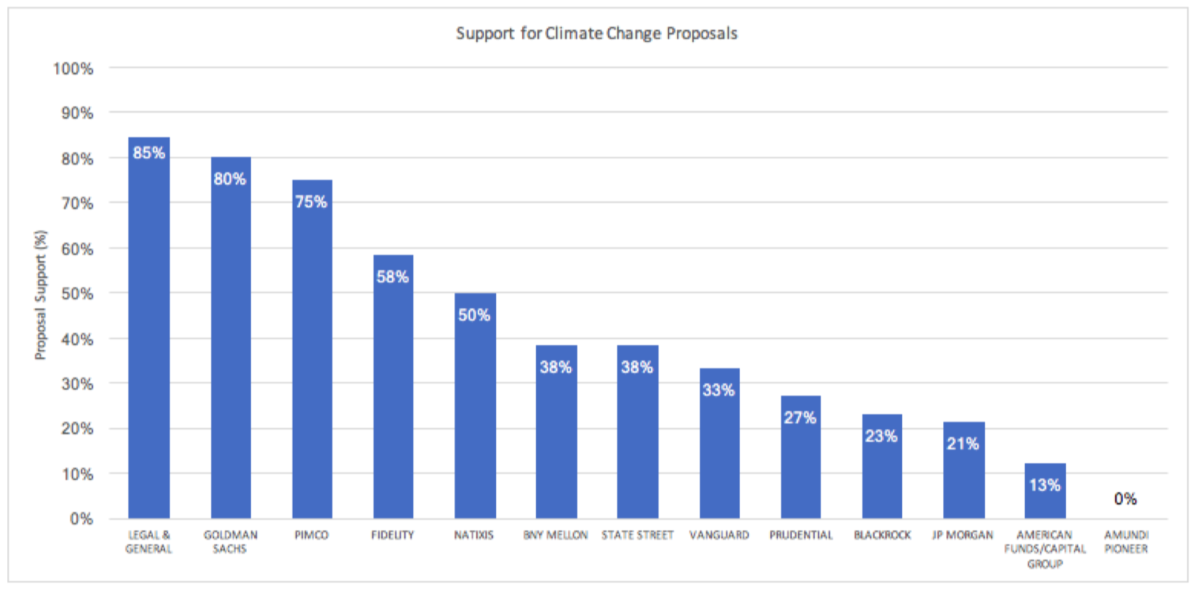

In 2018, the Climate Majority project examined the voting records of the largest asset managers with respect to climate-related proposals. Legal & General voted in support of climate change proposals 84.6% of the time. Vanguard by comparison, 33.3% of the time, and Blackrock only 23.1%.

Most notably, both BlackRock and Vanguard voted against two resolutions at ExxonMobil that would have created an independent chair of the board – a structural reform for climate accountability that would put a check on the CEO and board – and another requiring ExxonMobil to report it’s lobbying activity. BlackRock and Vanguard together control 14.7% of ExxonMobil stock — if they had voted for these resolutions, they would have passed. But their major funds voted against them.

What about divestment?

In June, London-based Legal & General announced that it had dumped about $300 million worth of its Exxon shares and would use its remaining stake to vote against the reappointment of Exxon Chairman and Chief Executive Officer Darren Woods.

“There’s got to be an escalation, you cannot have the same conversation for 15 years with no results”

Meryam Omi, Head of Sustainability & Responsible Investment at Legal & General.

They also release an annual report on firms across the oil & gas, automotive, food, mining & finance sectors that they see taking positive climate steps vs those excluded from investments on the basis of little progress.

Does divestment work?

Given someone else is buying the shares when you sell to divest – many argue divestment is solely a symbolic gesture. Bill Gates recently stated that fossil fuel divestment has ‘zero’ climate impact and some argue you should do exactly the opposite and invest in your ‘opposition’ as a mission hedge.

The counter argument is this neglects to account for the long-term increase in the cost of capital by doing so. Shell this year called divestment a “material adverse effect” on its performance, and co-founder of 350.org Bill McKibben writes about the potential huge impact of more banks stepping away from financing fossil fuel projects.

What choices do we have as individual investors?

In the end, I’ve decided to adapt my own portfolio for the primary reason that I’m simply not comfortable investing in firms that are damaging the future and doing little to nothing about it. I also suspect that fossil fuel focused investments will under-perform in the long run. As such, I’m taking two actions, where possible:

- Invest in funds that explicitly exclude the worst offenders with respect to climate change.

- Choose funds managed by institutions with a track record in using their voting rights to positively drive (or force) change in these businesses.

Climate friendly indices

Please note: This article is merely a record of my personal investment research. It is by no means comprehensive and should not be considered investment advice, nor an endorsement or recommendation of any investment or firm. Always do your own research! 🙂

Passive investment funds track an underlying index, of which there are now various available from the big index providers that claim varying degrees of climate friendliness. Taking a look at the methodology behind these underlying indices is worthwhile, prior to choosing investments that track them, as the approach can vary significantly. Some examples I’ve found include

- FTSE Global Climate Index Series

This similarly adjusts the constituent weights of their corresponding parent index based on three climate change related measures. Legal & General’s Future World Climate Change Equity Factors Index Fund is one example tracking this, possibly additionally excluding companies from the Fund which do not meet L&G’s “Climate Impact Pledge”. OCF (ongoing charges figure) 0f 0.3% and £280m AUM (assets under management). - MSCI SRI Select Reduced Fossil Fuel Index

Exclude companies that are inconsistent with specific values based criteria focused on products with high negative social or environmental impact. iShares MSCI World SRI UCITS ETF tracks this, listed in London but with a EUR base currency. - MSCI ACWI Ex-Fossil Fuels Index

- Any constituent identified as having fossil fuel reserves (proved & probable coal reserves, oil & natural gas reserves) that are used for energy purposes is excluded. I couldn’t find any UK fund managers tracking this.

- MSCI ACWI Low Carbon Target Index

Aims to address two dimensions of carbon exposure – carbon emissions and fossil fuel reserves by overweighting companies with low carbon emissions relative to sales and those with low potential carbon emissions per dollar of market capitalization. Amundi’s Equity Global Low Carbon index tracks this with OCF of 0.25% and €909M AUM. - S&P Global 1200 Fossil Fuel Free Index Series

Screens securities from the underlying index for those companies holding fossil fuel reserves – but note this doesn’t exclude others in the fossil fuel business. - S&P Global Clean Energy Index

Limited to clean energy producers or technology & equipment providers from the S&P Global Broad Market Index. iShares Global Clean Energy UCITS ETF tracks this with OCF of 0.65% and $290m AUM. - MSCI ESG Enhanced Focus

This series of indices take the constituents of the parent index adjusted for a 30% reduction in carbon exposure, and also excluding ‘controversial’ weapons and tobacco producers. Funds tracking this include iShares MSCI World ESG Enhanced UCITS ETF launched in May 2019, with an OCF of 0.2% and $15m AUM. - MSCI World SRI / MSCI World SRI 5% Capped

These exclude companies who have negative social or environmental impacts (note: Nuclear is also excluded), and then applies additional weightings based on their ESG rating. There’s nothing explicitly stated about targeting environmental over others here, but Morningstar rates these as ‘above average’ for environmental impact. If anyone can elucidate, please do! UBS have a GBP version of these funds. - STOXX Low Carbon Indices

With six sub-families offering varying degrees of carbon exposure, but I haven’t currently found any ETFs you can buy to track these.

There are also indices with a general ethical approach but no specific climate focus, including MSCI ACWI Sustainable Impact Index and MSCI World SRI (with funds from iShares and Amundi available) and Vanguard SRI Global Stock Fund.

If you’re interested in fixed income, MSCI have another extensive range of indices (with funds available such as the snappily named UBS ETF (LU) Bloomberg Barclays MSCI US Liquid Corporates Sustainable UCITS ETF), plus there’s the Solactive Green Bond index tracked by the Lyxor Green Bond.

Caveats…

You will have noticed many of these are iShares managed by Blackrock, who as noted above, have a poor record of voting on climate issues.

Indices marketed on their avoidance of fossil fuel stocks might still include fossil fuel-related companies. Energy producers typically are screened out due to holding reserves of oil, coal and natural gas, but oilfield services companies or utilities that still use coal- or natural-gas-fired plants may still be included. Sadly the devil is still in the detail.

Nuclear power is excluded from some of these funds as ‘controversial’ – which it is indeed. Depending on your view on the role of nuclear as part of the world’s future energy mix, you may want to review these inclusions/exclusions too.

Robo-advisors

If you’re a fan of robo-advisors, platforms like WealthSimple, Nutmeg and (much newer) Tickr offer socially responsible portfolios, many of which feature these. Plus there’s a new climate friendly ‘Vegan’ ETF.

Other resources

- Fossil Free Funds gives an insight into a (limited) set funds climate friendly-ness and carbon footprint. It combines Morningstar data on stock holdings with screens like the Carbon Underground 200, a global index of coal, natural gas and oil companies.

- The Bank of England joint statement on climate-related financial risks back in April 2019.

- Friends of the Earth briefing from January 2018 on issues coming up around divestment from fossil fuels in response to several local authorities doing so.

- Majority Action and ClimateAction 100 groups supporting shareholders in demanding climate action.

- InfluenceMap analyse how companies and trade associations impact climate policy.

- DIY Investor has blogged about switching away from fossil fuel firms in their own portfolio.

- Partnership for Carbon Accounting Financials working to establish a common standard on carbon accounting so financial institutions can assess and disclose greenhouse gas emissions of loans and investments

If you spot any inaccuracies or know of others I should have included, I’d love to hear! 🙂

One reply on “Climate friendly investing when you’re using passive ETFs and tracker funds”

Thanks for publishing your findings, James. This is going to be helpful!